International Tax Advice and Planning – North York

International Tax Advisor – International Tax Advice and Planning – North York

We are a full time tax practice that specializes in international tax. North York Tax Consulting practice areas include:

International Corporate Tax

Non-Resident Taxation

Real Estate Domestic and Abroad

Foreign Trusts

Offshore Tax

International Tax Treaties

Benefits of using North York Tax Consulting – International Tax Advice and Planning – North York

- Specialized International Tax Advisors

- Access to Global tax team in over 40 countries

- Can handle domestic tax so no need to use multiple advisors

- Ability to deal with multi jurisdictional tax law cases

- In-house international tax research team

Examples of International Tax Advice and Planning – North York

When you find yourself outside of your comfort zone, these are some examples of why individuals require a need for an international tax advisor:

- Are you inheriting a large sum of money or assets from a foreign trust?

- Have your financial affairs become more complex and international?

- Do you require international tax return preparation services?

- Are you changing legal form of business ownership (proprietorship to corporation)

- Are you starting a new business or purchasing a franchise in a new international market?

- Are you a non-resident individual or corporation?

- Are you purchasing your first rental property abroad and would like to know tax consequences of renting it out?

- Do you have international tax issues?

- Are you a new resident residing in Canada?

- Are you a Canadian citizen planning on moving abroad?

- Are you purchasing foreign property or investments?

- Do you have foreign tax liabilities that you are unable to pay?

- Are you adding complex investments to a new or existing international portfolio?

- Have an international tax problem or cross-border question that you can’t find the answer too?

- Have you been offered international employment and are not sure what tax issues may come up?

- You are interested in knowing how to setup a offshore holding company?

- Receiving or about to receive a foreign pension and are worried about double taxation?

- Adult children attending post secondary education abroad and would like to know if there are any tax implication in purchasing a foreign property for them?

There may not be one particular issue that would lead you to use an international tax advisor. Maybe the annual job of preparing your international tax return has finally become too complex, onerous, & time-consuming. Not sure, which international tax laws apply to you or your situation. If, you are no longer confident that you are getting the full benefit of every deduction and credit to which you are entitled or you do not wish costly fines and penalties by attempting it yourself. We can help.

We are approachable and experienced in multiple areas of international taxation. We take the stress out of taxes.

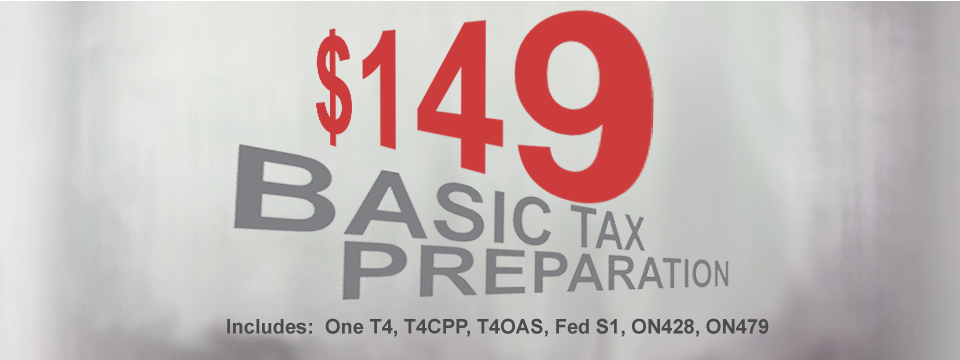

Personal Tax Returns

Corporate Tax Returns

Trust Tax Returns

US Tax Returns

Non Resident

Late Filings

Prior Year Adjustments

Demand to File

TFSA

Deceased Returns

Bankruptcy Returns

Arrival & Departure Returns

Tax Advice & Planning

Personal Taxation

Corporate Taxation

Trust & Estate Tax

Cross Border (US Tax)

International Tax

Investments & Tax

Real Estate & Tax

Retirement Planning

Financial Planning